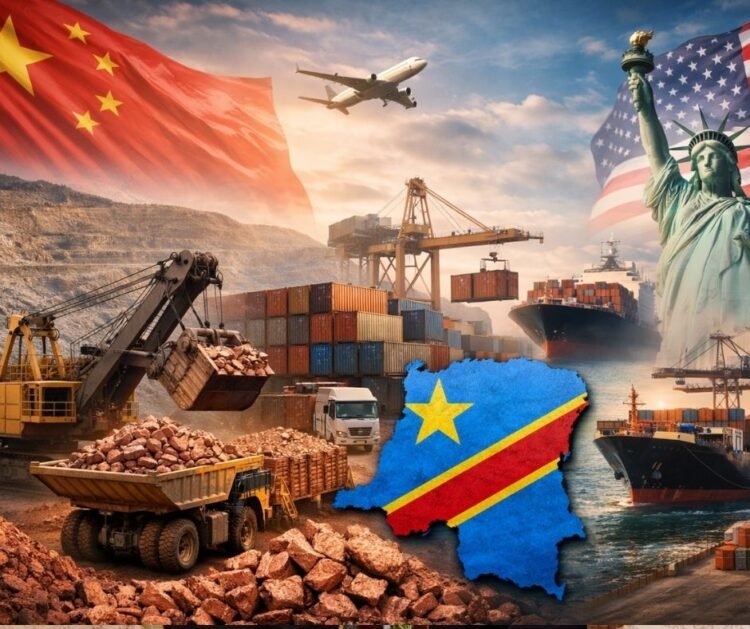

The Democratic Republic of Congo has confirmed plans to ship 100,000 metric tons of copper from a Chinese-run mine to the United States by the end of January, following its submission to the U.S. administration of a list of state-backed mining projects for potential investment

The move shows a clear step toward trading minerals in exchange for investment, linking economic cooperation with regional security, while also signaling the DRC’s plan to work with a wider range of international partners.

The mine is operated by China’s CMOC Group Ltd. in partnership with the state-owned Gécamines SA. Since 2016, CMOC has held an 80% controlling stake in the operation.

The Chinese mining company, one of the world’s largest producers of copper and cobalt, has invested an estimated $2.5 billion in the project. Over the period under review, CMOC sold 689,521 tons of copper, generating $5.82 billion in revenue, and 108,892 tons of cobalt, contributing $1.22 billion.

However, in an effort to consolidate oversight and assert greater national control over strategic minerals, Congolese authorities temporarily suspended cobalt exports for four months.

Despite the suspension, CMOC continued production and stockpiling. In the first quarter of 2025, the group produced 30,414 tons of cobalt, a year-on-year increase of 20.7%, while maintaining its annual production forecast of 100,000 to 120,000 tons.

Notably, since the export suspension, cobalt prices have rebounded by 57%, underscoring the impact of constrained supply and reinforcing CMOC’s stockpiling strategy.

In parallel, and as part of broader efforts to strengthen state participation and secure access to U.S. markets, DR Congo established Gécamines Trading, a subsidiary responsible for acquiring and marketing minerals from state-backed operations.

“We are pleased with this first operation, which brings to fruition work carried out for more than a year to strengthen the position of the Democratic Republic of Congo on the global stage of raw materials and to realize the Congolese State’s objective of asserting sovereignty over its subsoil,” said Placide Nkala Basadilua, Director General of Gécamines SA.

While the U.S. Census Bureau did not specify the drivers behind the surge, the United Nations Economic Commission for Africa (UNECA) attributed it to sustained U.S. demand for African raw materials and trade diversion as global supply chains shift.

Historically, copper from the DRC accounted for only a marginal share of U.S. imports, which were dominated by Latin American suppliers.

However, the sharp increase reflects a strategic shift, as Washington seeks stakes in African mines while deepening engagement with mineral-rich countries to counter China’s influence in critical supply chains.

CRACKED CRYSTAL: TRUMP’S ‘GOLDEN DOME’ STALLS AMID ARCHITECTURAL FRAGMENTATION